Welcome to the 66th Edition of the Lenders Digest.

The newsletter is designed to report on recent data of interest and none of the following should be taken as financial advice. You should seek professional advice before making any investment decisions.

The jobs market continues to weaken, in accordance with the forward looking job ads charts (the seek one had been projecting for higher unemployment for some time). The growth in NDIS has been a major savior for the employment market.

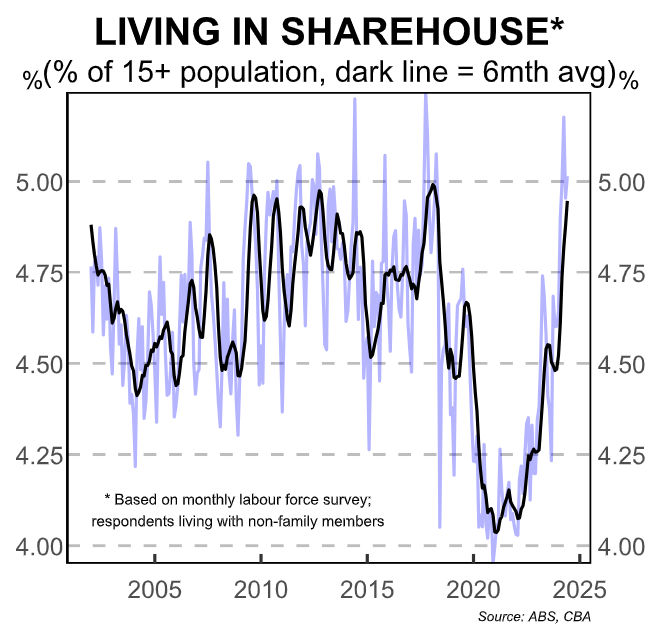

I’ve included some interesting charts from Macrobusiness/CBA below

Australian Property Market

The market continues to trend upward according to the daily Corelogic figures.

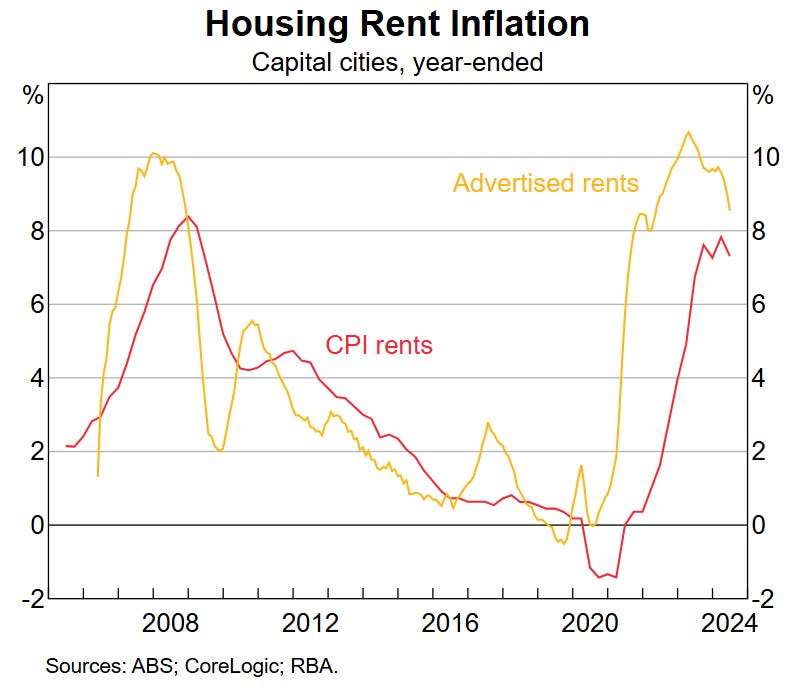

Meanwhile asking prices continue to dip in Sydney, and Canberra, while Perth and Brisbane remain strong for the moment. Rental asks are trending downward on a national basis now.

Inflation Overseas

UK inflation remains in a similar place to last week, well above the lows but far from at a high level currently.

US inflation data continues to trend downward.

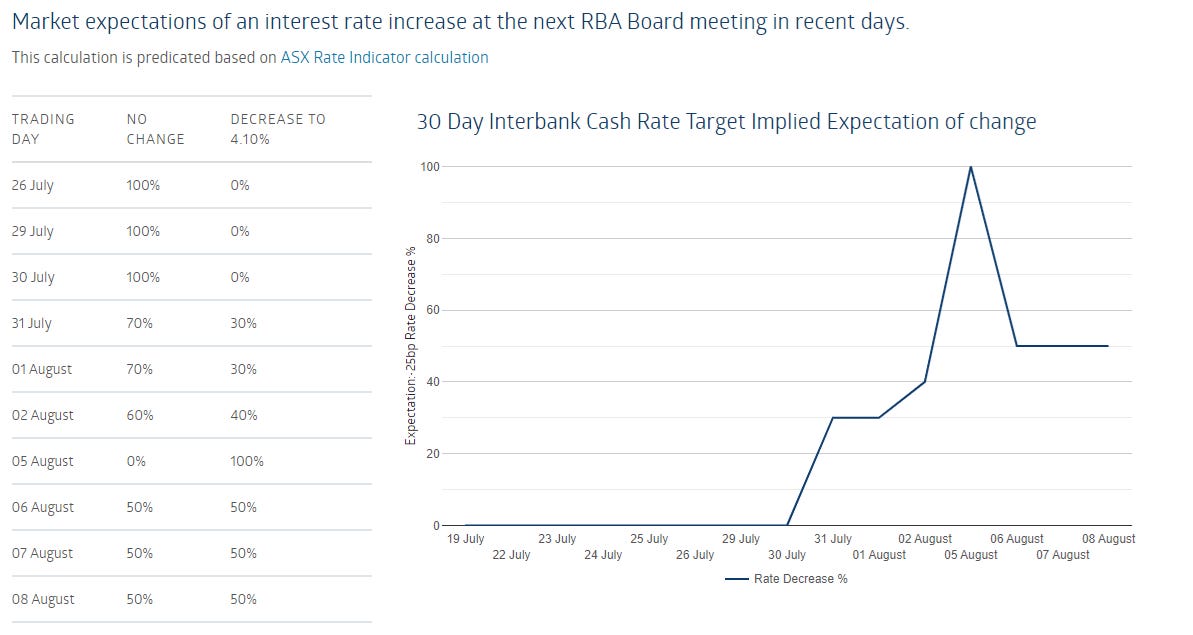

ASX Rate Tracker Index

The rate tracker index is now pricing a 50/50 chance of a rate cut at the next RBA meeting.

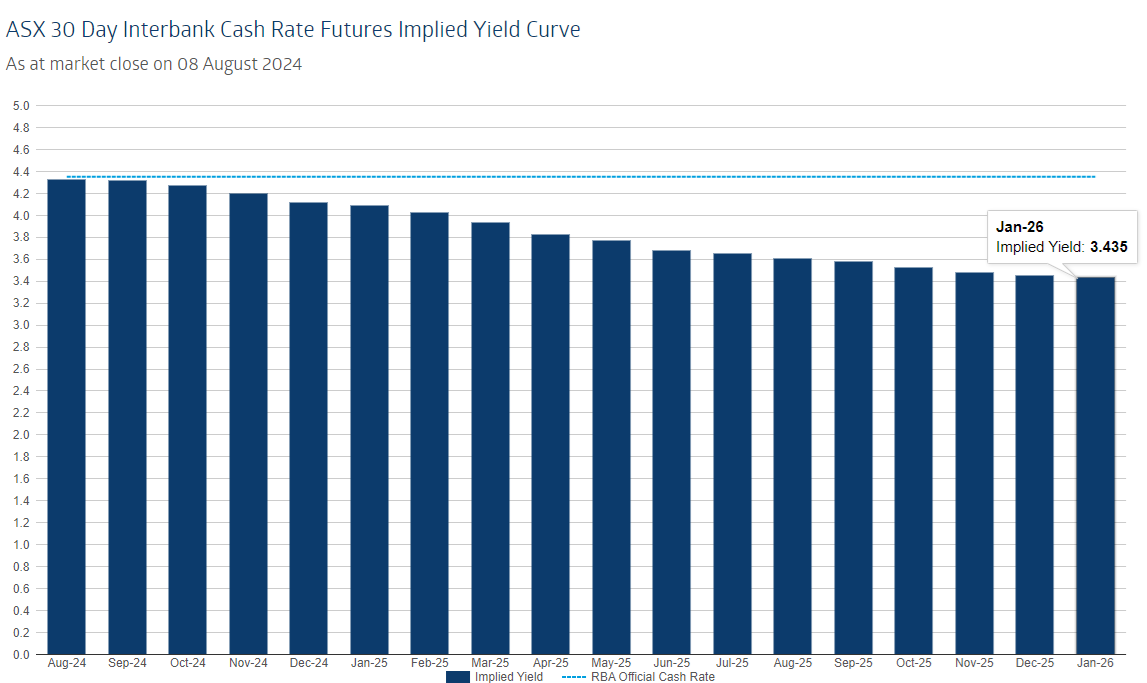

Meanwhile the yield curve indicates that rates are likely to be cut nearly a whole percent in the coming 18 months

M